Climate and Task Force on Climate Related Financial Disclosures (“TCFD”) Approach

As a responsible investor, Affinity fully recognises the importance of understanding climate related risks and opportunities and integrating these into our investment processes. As a supporter of TCFD, we are committed to the TCFD’s recommendations. We seek to continually enhance our disclosures and encourage our portfolio companies to use the TCFD framework to understand and report on their climate related risks and opportunities. Our disclosure of the TCFD’s core elements, Governance, Strategy, Risk Management, and Metrics and Targets is laid out below.

- Governance: Climate-related considerations are embedded in Affinity’s governance structure. Our Investment Committee considers climate-related risks and opportunities as they make decisions on each investment. The Founding Chairman of Affinity oversees our ESG Policy, which includes our approach to climate change.

- Strategy: Affinity considers the physical and transition risks and opportunities of climate change on our portfolio. We see that the transition risks of climate change, such as regulatory and changes in consumer preference, have a stronger impact on our investment strategy, especially in the Asian markets where we operate, and have done analysis into where new climate related investment opportunities may arise.

- Risk Management: Climate related risks and opportunities and TCFD requirements are embedded into our ESG Policy and Guidelines and implemented in our investment processes. Climate risk factors are considered as part of pre-investment due diligence. Post investment, we assess the overall climate risks of our portfolio. Where applicable, we perform scenario deep dives for portfolio companies understand their climate risk and build climate risk mitigation plans.

- Metrics and Targets: In 2021, we used TCFD’s recommended carbon portfolio metric, the Weighted Average Carbon Emissions (“WACI”), to measure and report on the Scope 1 and 2 emissions of our Fund V portfolio. Our WACI in 2021 was 17.4tCO2e per million dollars revenue.

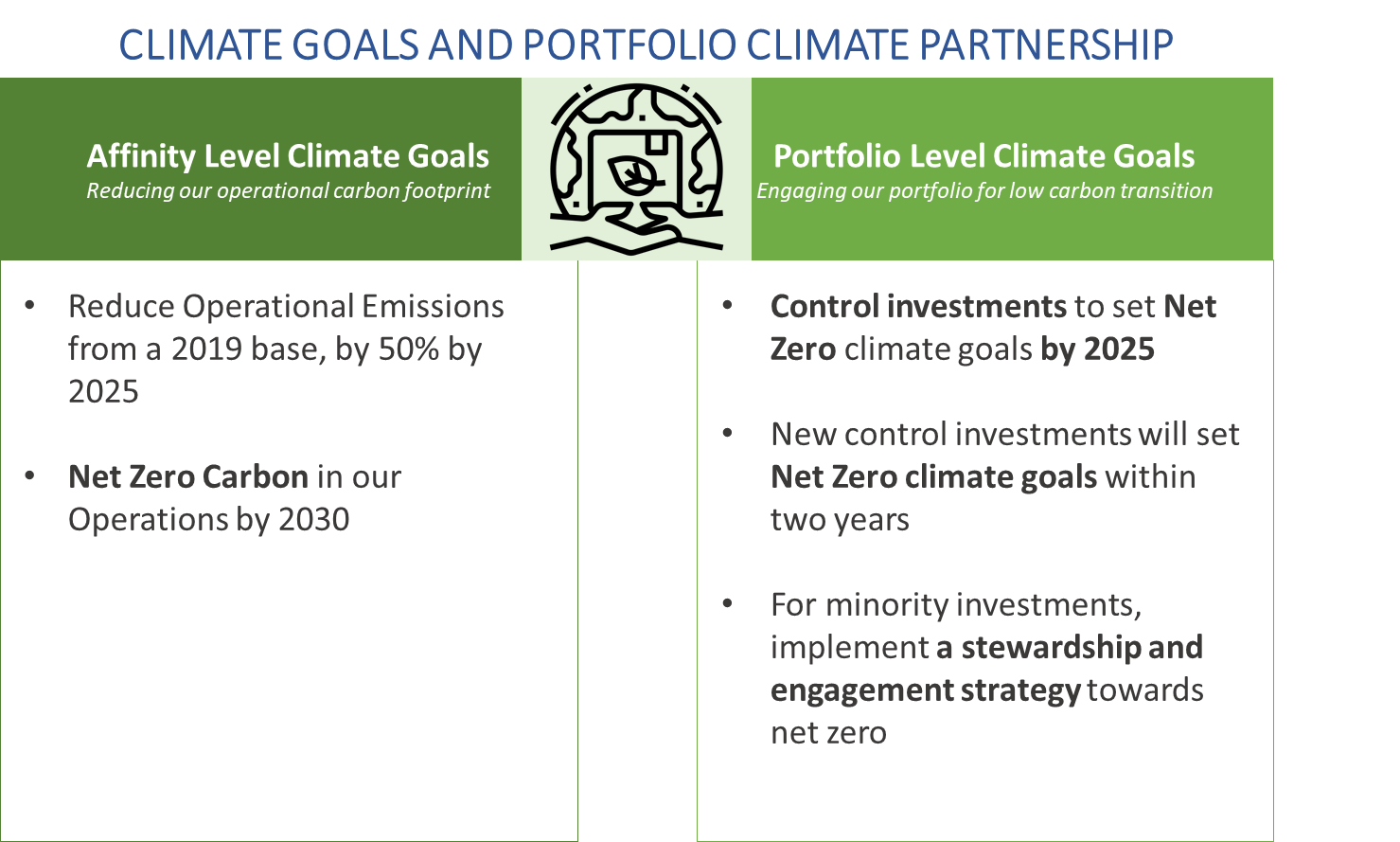

- In November 2022, we announced our climate goals.

- At the GP level, we aim to reduce our own operational emissions from a 2019 base by 50%, by 2025, and to be net zero in our operations by 2030.

- At the portfolio company level, we aim to have current control investments set net zero climate goals by 2025. For new control investments, we aim to have them set net zero climate goals within two years of ownership. For minority investments, we intend to implement a stewardship and engagement strategy consistent with this approach.